At the end of last year it was great to get out and present in person to a packed room, at the Global EPC Project Management Forum in Amsterdam. Even better was the interest and feedback I received from my presentation ‘Are you taking the right amount of risk?’.

Not being a fan of death by PowerPoint, I gave a brief introduction about the well-known issues of delivering projects on time and on budget. A scatter graph showing project cost and time overruns really brought the message home. In contrast to examples of 9-year schedule and 600% cost overruns, I was also able to give examples of the London 2012 Athletes Village coming in early and Babcock increasing project profit margin. Not surprisingly, both used our Predict! risk management and analysis software.

Then, a quick recap of the difference between risk and uncertainty before I took my life in my hands for a live demonstration!

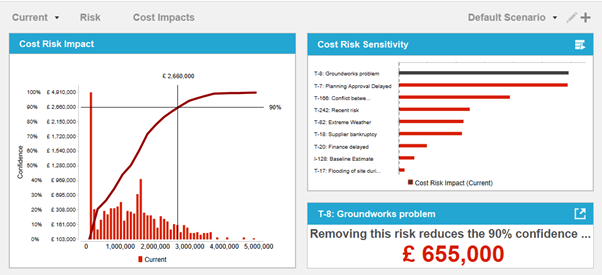

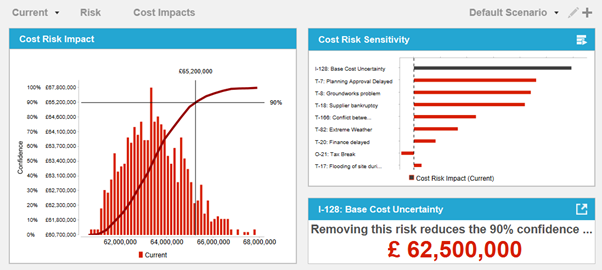

A single click from a project risk register in Predict! Risk Controller ran a Monte Carlo Cost Risk Analysis (CRA) in Predict! Risk Analyser. The interactive dashboard immediately shows me how much risk I am exposed to at my chosen confidence level. Simply using this instead of giving the project manager a contingency of x% of the project budget enabled Babcock Rail to increase margin on projects by 2%.

I then enhanced the model by bringing in cost estimates, along with uncertainty factor ranges. This enabled me to show the confidence of delivering the project for the desired bid price.

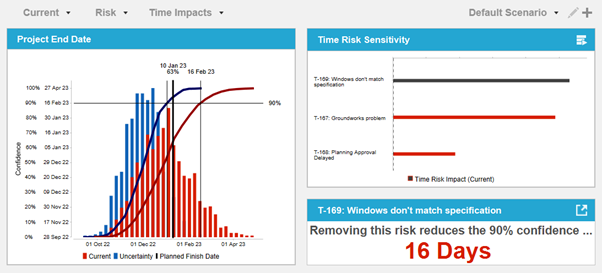

Finally, I performed a combined cost and schedule analysis. The dashboard now displaying the confidence of delivering on or before the deterministic schedule date. Unfortunately, this first pass showed less than a 50% chance. If I wanted a date I could be 90% confident of making I needed an extra 2 months – on a project that was only 18 months long.

So I performed a simple ‘what if’ to see what would happen if I could halve the potential impact of my top risk, which incidentally the dashboard showed was adding over 36 days to my end date. This resulted in my 90% end date confidence reducing by a month.

Best of all, I had a quick and easy way to demonstrate and convince management of the need to perform the proposed risk mitigation actions (including the cost-benefit).

Whilst on the subject of 90% confidence dates, you might be interested that the 2012 Athletes Village ran QSRAs monthly to ensure that their 100% confidence date was earlier than their scheduled delivery date. You can’t be late for the Olympics!

All of this in 30 minutes, so very much a whistle stop tour. It did though whet the appetite of many in the audience, as I was kept busy with people wanting to find out more for the next two days.

Click here to watch the full recording and download the slides of ‘Are you taking the right amount of risk?’

EPC Summit 2023 | Amsterdam Energy (Amsterdam-energy-summit.com)

Learn more about Predict! Risk Analyser

Trevor Jay – Technical Sales Manager

Trevor Jay – Technical Sales Manager